Question:

I have heard from several new credit card companies that it is now legal for an owner of an establishment to pass on their credit card charges to their customers. Has there been a new law passed?

– Jeff Root, Owner, Dana’s Grill and Sports Bar, Eau Claire, WI

Answer:

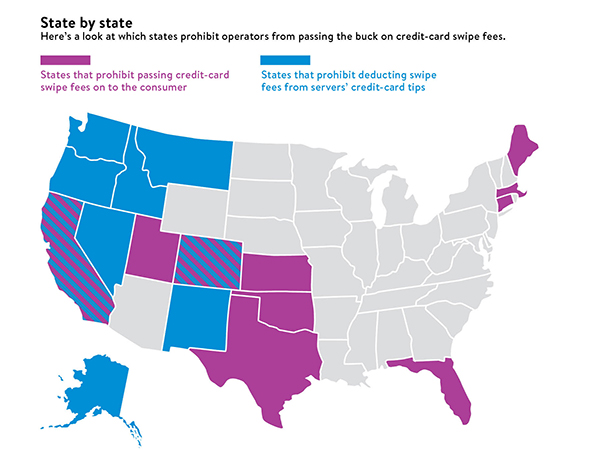

In all but ten states—California, Colorado, Connecticut, Florida, Kansas, Maine, Massachusetts, Oklahoma, Texas and Utah—passing credit card swipe fees onto the consumer is allowed, as of January 27, 2013.

Credit card companies tend to point out this possibility to minimize the perception of the size of fees. For example, if you add a two-percent surcharge to every credit card transaction, a four-percent deal seems less painful.

In reality, however, there is a difference between having the ability to levy a surcharge and the guest service implications of doing that. Surcharges may anger guests, building resentment and prompting them to look for options elsewhere in the future.

My advice is to negotiate the best merchant agreement possible and nudge menu prices up if needed, but consider swipe fees the cost of doing business with credit cards. Passing the fees onto the consumer will see more harm than benefit unless the entire industry moves together on this issue. If you do go with a surcharge, be sure to follow the rules. For example, the fee cannot exceed 4 percent, must be posted so guests can see it before paying, cannot be used on debit cards or government purchases, and must be clearly indicated on the receipt.

More on passing on credit card swipe fees to guests here.